While there are many different types of exhaust systems available on the market, it is important to consider a few key factors before making your purchase.

You need to decide what type of system you need based on the make and model of your car. You need to take into account the level of performance you require from your system. Lastly, you need to factor in the cost of the system and installation.

Finding the right exhaust system for a car is not an easy task. While you might think that the best exhaust system just has to be the most expensive, this article will show you how to install and find the best exhaust system.

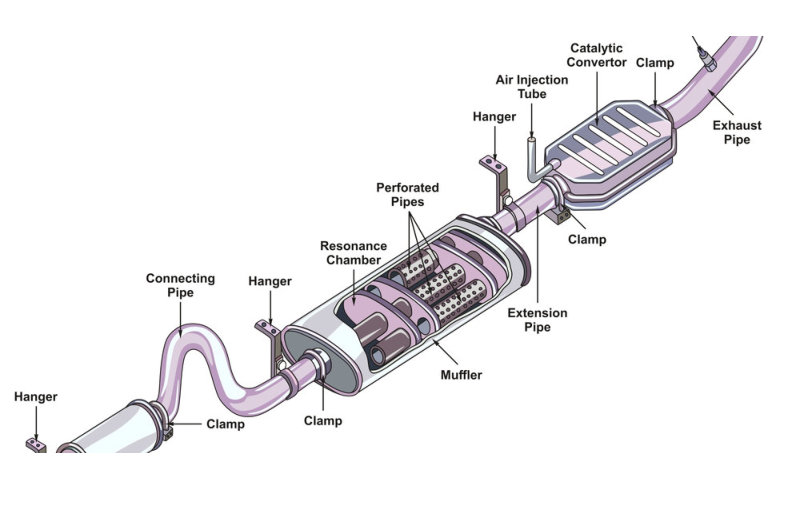

Image Source: Google

Types of Exhaust Systems

1. Cat-back Exhaust Systems

2. Header-back Exhaust Systems

3. Turbo-back Exhaust Systems

How to Install an Exhaust System

Assuming you have already purchased your exhaust system, the following is a guide on how to install it. The process may vary depending on the make and model of your car, but the general idea is the same.

1. Begin by disconnecting the negative battery cable. This will prevent you from accidentally electrocuting yourself while working on the car.

2. Next, locate the old exhaust system and detach it from the car. This usually involves removing bolts or screws that hold it in place.

3. Once the old system is removed, take a look at the new system and identify where it needs to be attached. In most cases, you can simply line up the new system with the old one and use the same attachment points.